colorado estate tax rate

Parcel Viewer Online Maps. All of the tax rates of the various taxing authorities providing services in your tax area are added together to form the total tax rate.

How A 2010 Colorado Law Suddenly Stands To Change Internet Sales Tax Collection For Good Viral Marketing Marketing System Tax Lawyer

City Tax Rate 0008752.

. Current Property Tax Balance. Colorado collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws.

This interactive table ranks Colorados counties by median property tax in dollars percentage of home value and percentage of median income. The state of Colorado for example does not levy its own estate tax. Colorado also has a 290 percent state sales tax rate a max local sales tax rate of 830 percent and an average combined state.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income. Unlike the Federal Income Tax Colorados state income tax does not provide couples filing jointly with expanded income tax brackets. Counties in Colorado collect an average of 06 of a propertys assesed fair market value as property tax per year.

Greens land multiply the assessed value times the decimal equivalent of the total mill levy. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Stakeholder Workgroup Meeting Foreign Source Income and Corporate Subtraction for Section 78 Dividends.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. However estate income tax returns can be fairly complex even if there is very little income.

Colorado has a flat 455 percent state individual income tax rate. Tax amount varies by county. Revenue from Property Tax Total Assessed Value.

Unlike some states Colorado does not currently. The Colorado Department of Revenue Division of Taxation is convening a stakeholder workgroup to discuss the promulgation of the following new and revised income tax rules. County Tax Rate 0013980.

Online Treasurer Tax Records. Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. Thus 9842 mills 9842 percent or 09842 as the decimal equivalent.

06 of home value. A state inheritance tax was enacted in Colorado in 1927. Median property tax is 143700.

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. The Colorado EITC is equal to 10 of the federal EITC youre eligible for based on your income.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. Estate income tax is a tax on income like interest and dividends.

However not many states have an estate tax. The first step towards understanding Colorados tax code is knowing the basics. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000.

Or 13980 mills. Green s assessed value is 43500. May increase with cost of living adjustments.

No estate tax or inheritance tax. A mill is equal to 11000 of a dollar. While federal law still imposes estate taxes on certain estates only about two of every 1000 people who pass away or 02 percent have to pay any taxes at all.

Federal legislative changes reduced the state death. So if youre. Assessor Property Record Search.

The initiative would limit the annual increase in property tax revenue on a property to 2 unless the property is substantially improved by adding more than 10 square footage or the propertys use changes. Colorado imposes a sales tax rate of 290 percent while localities charge 475 percent for a combined 765 percent rate. There are jurisdictions that collect local income taxes.

Colorado Property Taxes by County. To calculate the property tax for Ms. Change of Address Form.

School District Tax Rate. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. A state inheritance tax was enacted in Colorado in 1927.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022. Jared Polis Democratic lawmakers and Colorado Concern a deep-pocketed business organization hastily negotiate a plan to provide relief thats sufficient but that doesnt also deny local governments billions in future funding. However if the decedent owned any sort of real property the estate must apply for normal probate.

Estate tax can be applied at both the federal and state level. The list is sorted by median property tax in dollars by default. Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim this.

For 2021 this amount is 117 million or 234 million for married couples. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. 2 days agoThe debate over how to tackle rising property taxes is poised to dominate the final days of Colorados 2022 legislative session as Gov.

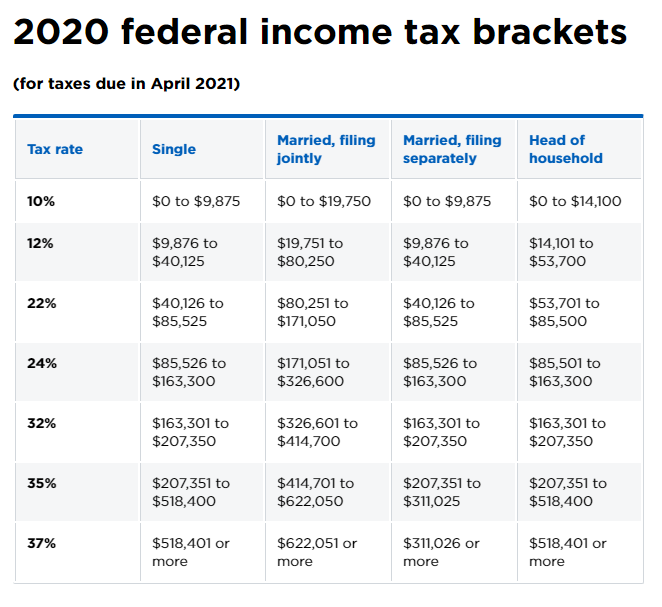

The tax rate is often expressed as a mill levy. Colorados maximum marginal income tax rate is the 1st highest in the United States ranking directly below Colorados. The maximum federal EITC amount you can claim on your 2021 tax return is 6728.

13 rows Property taxes in Colorado are among the lowest in the country with an average effective. A tax rate is the mill levy expressed as a percentage. Federal legislative changes reduced the state death.

Colorado has a 455 percent corporate income tax rate. Colorado is ranked number thirty out of the fifty states in order of the average amount of. The Colorado Annual Property Tax Revenue Limit Initiative may appear on the ballot in Colorado as an initiated constitutional amendment on November 8 2022.

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Voters To Decide On Whether To Cut Income Taxes On The 2022 Ballot

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Tax Rates Stranger Tallman Lautz Accounting Grand Junction Colorado

Property Taxes In Colorado Simplified Part 2 Ranch Resort Realty

Property Taxes Understanding Your Colorado Tax Bill

How To Plan Around Estate Tax Uncertainties Charles Schwab In 2021 Estate Tax Capital Gains Tax Tax

Colorado Property Tax Calculator Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Colorado Estate Tax Do I Need To Worry Brestel Bucar

4475 S Drummond Street Colorado Springs Co 80906 Mls 3065586 Savvycard Estate Homes Real Estate Home

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Get Started On Homeownership First Time Home Buyers Va Mortgages Mortgage

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

State By State Guide To Taxes On Retirees Retirement Tax Income Tax